The Singapore real estate market is likely to remain buoyant in 2023 - (The Business Times)→

/Before many people could fully comprehend what virtual currencies were, the year 2022 has been dubbed the "year of the crypto crash" because of the sudden loss of their appeal. The Nasdaq Composite Index dropped by a third as tech stocks crashed, hurting the stock market as well. However, despite factors like the Ukraine war, post-pandemic inflation, and global supply chain constraints, brick-and-mortar real estate in Singapore has withstood the crypto storm in the background and advanced to greater heights. On several trends in the Singapore real estate market, various market observers and analysts appear to agree.

Read the full article on The Business Times

Prices of Tengah homes near ACS (Primary) could rise 10% to 15%: Property Analysts (Channel News Asia)→

/Singapore: Homes in Tengah within 1 km of the relocated Anglo-Chinese School (Primary) may sell for up to 15% more than other units in the neighborhood due to the high demand for properties near popular schools, according to real estate analysts. In 2030, ACS (Primary), which is currently located off Bukit Timah Road on Barker Road, will relocate to Tengah, according to the Ministry of Education (MOE). After the relocation, girls will begin enrolling at the boys' school as well.

The new location is close to public housing developments still under construction, including Tengah Plantation and the Copen Grand executive condominium.

According to Ms. Christine Sun, senior vice president of research & analytics at OrangeTee & Tie, "In Singapore, many parents go to great lengths to secure a place in good schools by renting or paying top dollar for a nearby property." "More people appear to be buying or renting homes near good schools since MOE's recent change of allocating more spaces to Phase 2C." Children without any affiliations with a school should register for school in Phase 2C. Priority is given to Singaporeans in this phase who live less than one kilometer from the school.

Read the full article on Channel News Asia

For Real Estate Needs, Contact Michael Ciola At +65 9475 4785

Singapore, Dubai to lead price growth in prime residential markets amid slowdown worldwide (The Business Times)→

/According to Savills on Tuesday (Feb. 7), SINGAPORE and DUBAI will have the top-performing prime residential markets worldwide in 2023, with capital values in the two wealthy hotspots expected to increase by 6 to 7.9%. It did, however, point out that neither market is immune to rising interest rates and broader economic headwinds. In comparison to last year's 6.8% growth in prime residential capital value, Singapore's forecasted prime price growth is flat. The Republic's average prime capital value in December 2022 will be $1,780 per square foot (psf).

As 2023 approaches, there aren't many new launches in Singapore's luxury residential market. The potential for this area of the private residential market to outperform the others is very high, according to Alan Cheong, executive director of research and consultancy at Savills Singapore. China has recently reopened its borders to foreign travel. Dubai's anticipated increase in prime prices is modest compared to its projected increase in capital value of 12.4% in 2022. In December 2022, the average prime capital value was US$730 per square foot. The average price growth for the 30 global cities tracked by Savills' prime residential world cities index is predicted to be 0.5% in 2023, signaling a slowdown in many prime residential markets around the world.

Read the full article on The Business Times

For Real Estate Needs, Contact Michael Ciola At +65 9475 4785

Poll Survey says: Developers turn conservative in pricing approach to residential projects - (The Business Times)→

/A quarterly poll of the real estate industry revealed that as confidence in the business weakened, DEVELOPERS may be becoming more conservative in their pricing of residential projects.

71% of developers surveyed in the fourth quarter predicted that costs for new launches in the following six months would "remain at the same price level," an increase of 38 percentage points from the third quarter. Meanwhile, 29% of respondents thought new launch pricing would be "moderately higher". 56% of respondents in Q3 anticipated rising prices.

The National University of Singapore's (NUS) Institute of Real Estate and Urban Studies conducted the poll (IREUS).

Read the full article on The Business Times

New Report - Private Residential Sales Q4 2022 (Chinese Version)

/We are pleased to share the Chinese version of our Private Residential Sales Report Q4 2022.

Key Highlights

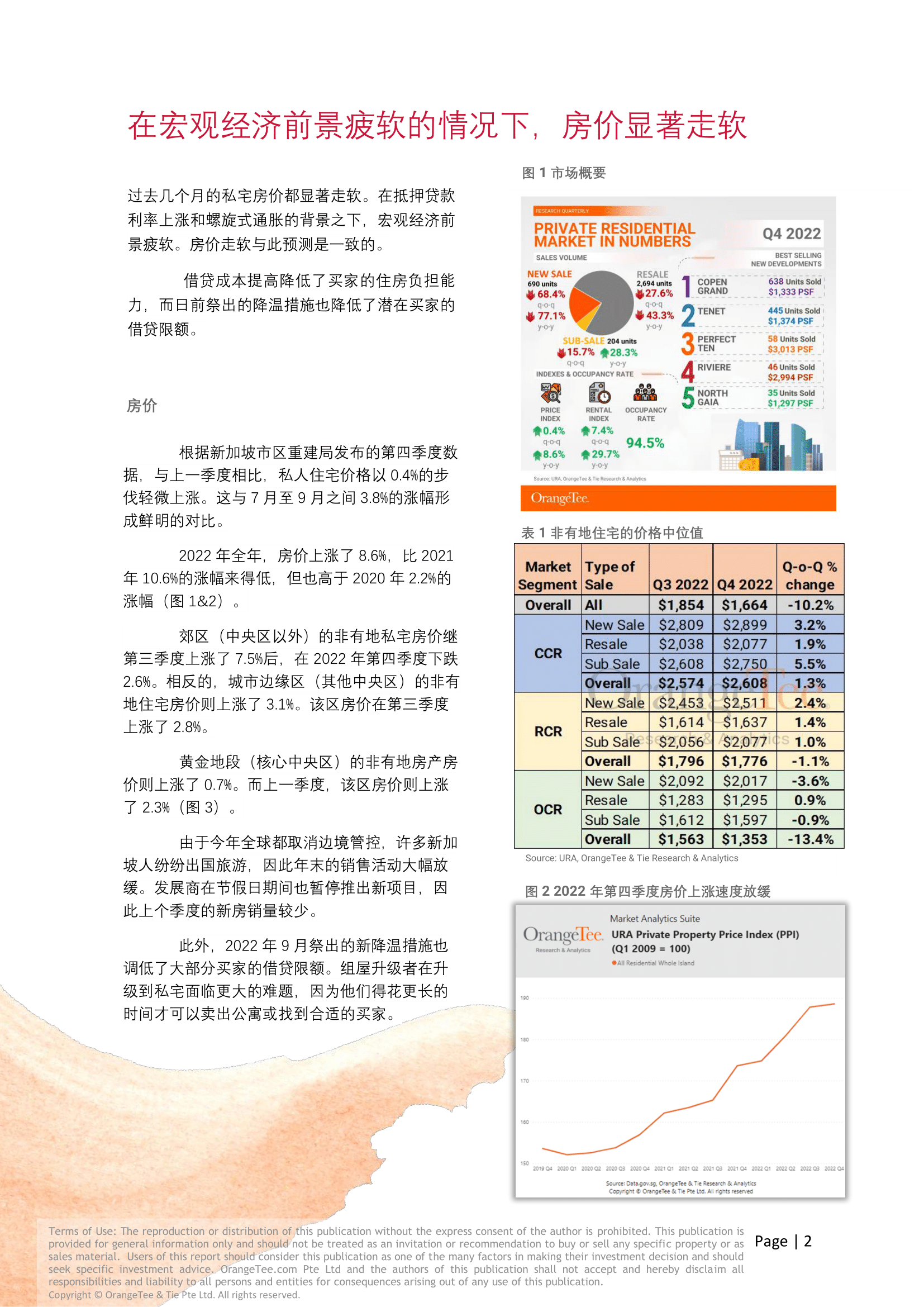

1. Private home prices rose slower last quarter on interest rate hikes, year-end holidays, cooling measures and lack of new home launches.

上个季度的私人住宅价格轻微上涨因为利率上涨, 大部分买家都出国旅游, 日前祭出的降温措施和年末假期缺乏新项目推出。

2. Sales volume dipped last quarter amid the year-end holidays and lack of new launches.

上个季度的销售量有所下滑。这是因为大部分买家都出国旅游和年末假期缺乏新项目推出。

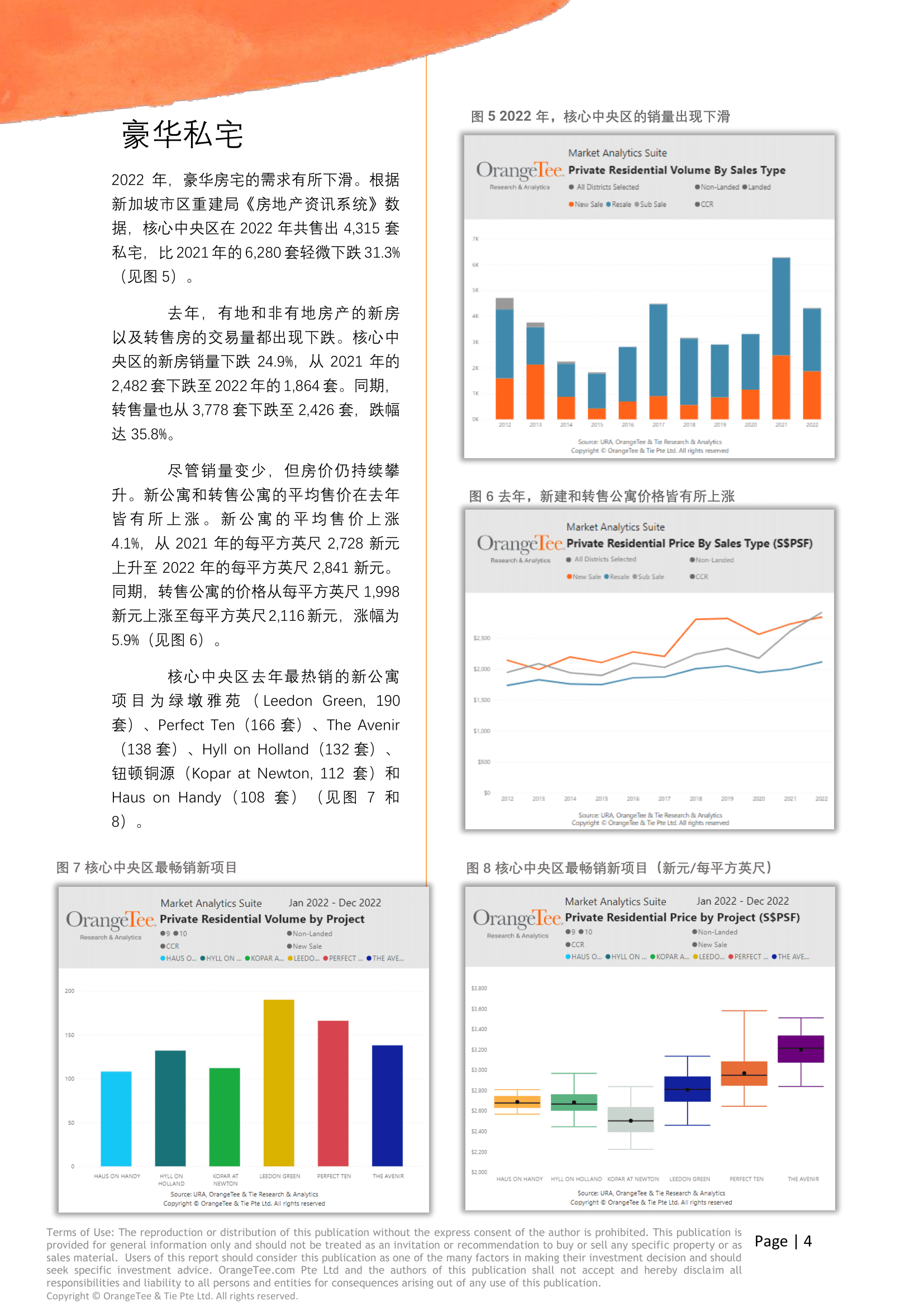

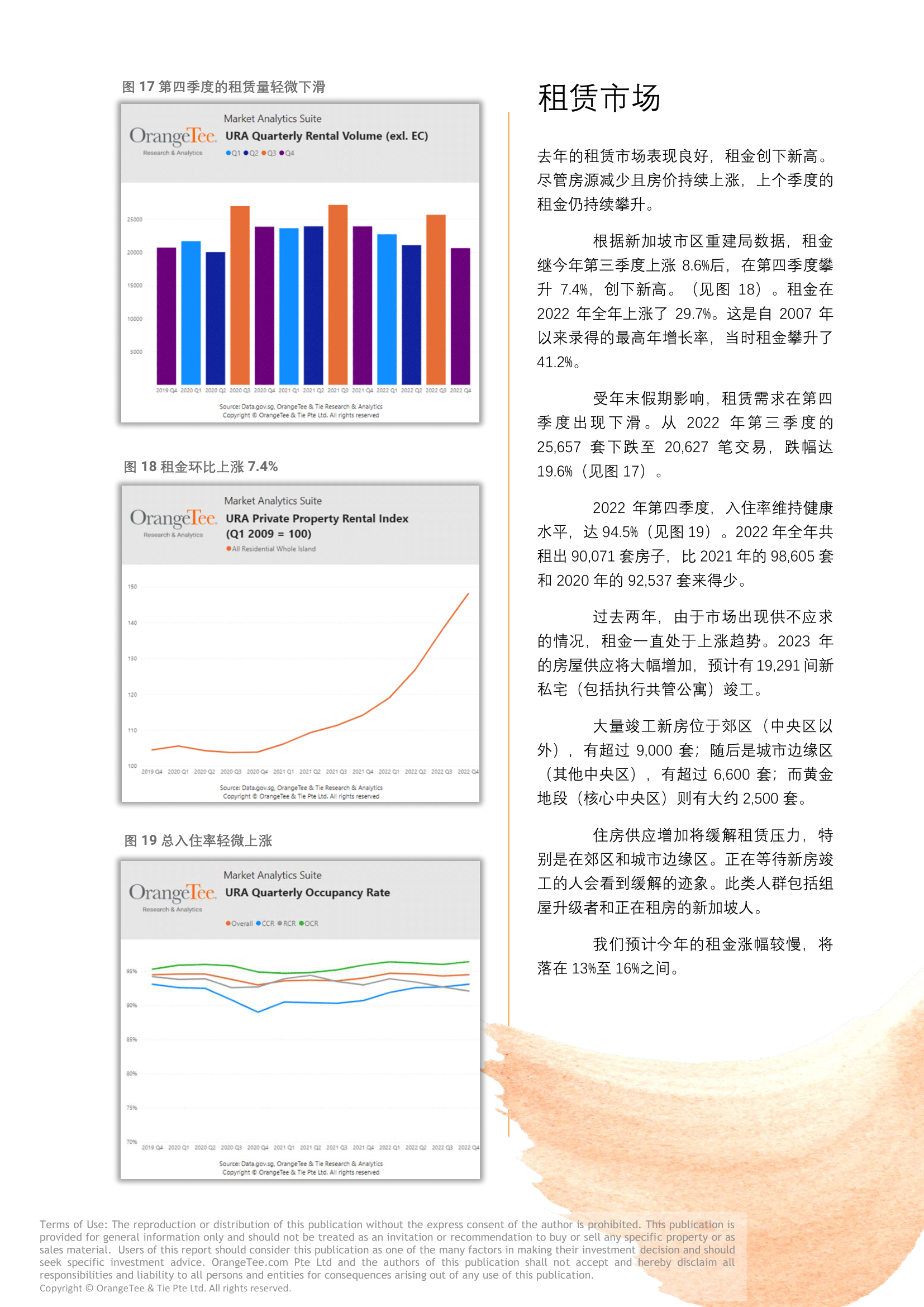

3. The leasing market performed well last year as rents hit a record high.

去年的租赁市场表现良好,租金创下新高。

4. Prices are expected to grow slower by 5 to 8 per cent this year.

今年房价上涨速度将会放缓,介于5%至8%之间。

Thank you

OrangeTee & Tie Research & Analytics